It’s a very busy week coming up with top tier data and major central bank meetings. With markets now finally agreeing with the Fed’s 75bps of policy easing this year, it’s now time for the economic data to further cement this pricing. The dollar has lost some of its shine after peaking in mid-February, so more upside surprises will be needed to kick off another upleg. The soft landing scenario is now baked in, but there are some concerns about small banks in the US and their exposure to commercial real estate. A blow-up here could potentially see some risk-off and stocks come under pressure, though the bulls do look very strong.

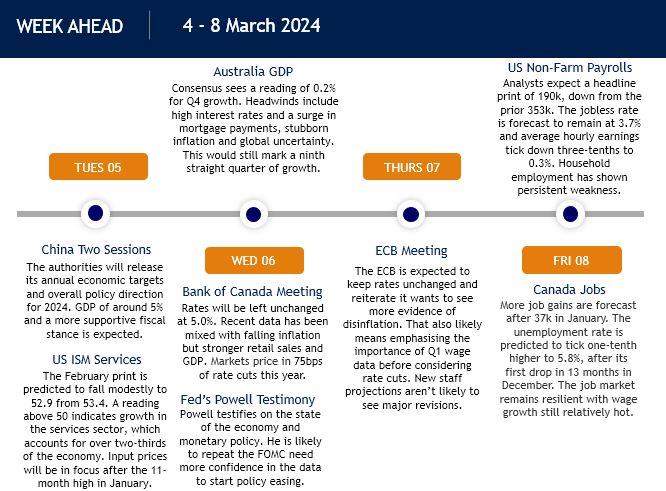

Fed Chair Powell testifies in front of Congress on next Wednesday, where he will probably show a willingness to take rates out of restrictive territory when the FOMC have full confidence in the data. But we are not there yet and while, the monthly US employment report is not expected to run as hot as the blockbuster data we saw in January, the labour market still remains tight. Those blowout figures added to the other strong data we have been seeing in recent weeks like inflation and GDP. At some point, the most aggressive rate hike cycle in decades, and tight credit conditions should hurt the economy as household finances suffer due to high borrowing costs. But the solid labour market has continued to astound, even though the household survey in the US points to fewer employed people each month over the last 12 months.

The ECB meeting could be a major market mover for the euro as bulls try to keep EUR/USD above 1.08. Policy settings will be kept unchanged, but the bank could lay the ground for a June rate cut. We’ve heard from a varied chorus of Governing Council members over recent weeks. Interestingly, the doves have avoided fuelling rate cut expectations while the hawks have been more explicit in dismissing the chance of an early rate cut. The latest macro data has been soft, and inflation has ticked lower. However, underlying prices pressures remain sticky so any changes to the inflation outlook will be key. For example, a “balanced” risk assessment would be a strong signal in favour of rate cuts and hit the euro.

The Bank of Canada meeting will also be of interest even though rates will be kept unchanged. Policymakers don’t expect inflation to fall to the target of 2% until 2025. But small dovish shifts by the bank have been evident and cooling growth should mean concerns about elevated inflation fade. For now, Canada has a high correlation with the US regarding rate cut expectations. A concerted push back against early rate reductions will be needed to help the CAD. Aside from the yen and CHF, the loonie has been the weakest major currency in the last few weeks.

Here are the main events: