The new year has kicked off with a reversal of the 2023 year end mega-rally in stocks and bond markets. Traders have returned to their desks and poured a small glass of cold water on the aggressive rate cut expectations which were being baked into central bank pricing for the months ahead. Friday’s key monthly US employment report showed still solid job gains, with low unemployment and sticky wages also suggesting there probably won’t be a rush to ease policy just yet.

This week sees the release of the second part of the Fed’s mandate, inflation, shape price action. The FOMC seem to be fairly comfortable with current price pressures as upside risks are deemed to have diminished. But markets still see a high chance of a Fed rate cut in March as the central bank’s favoured inflation measure, the core PCE deflator, has been softer than the more widely followed CPI data. The dollar started 2024 on the front foot but prices in the DXY just about remain in a descending channel from the late October highs.

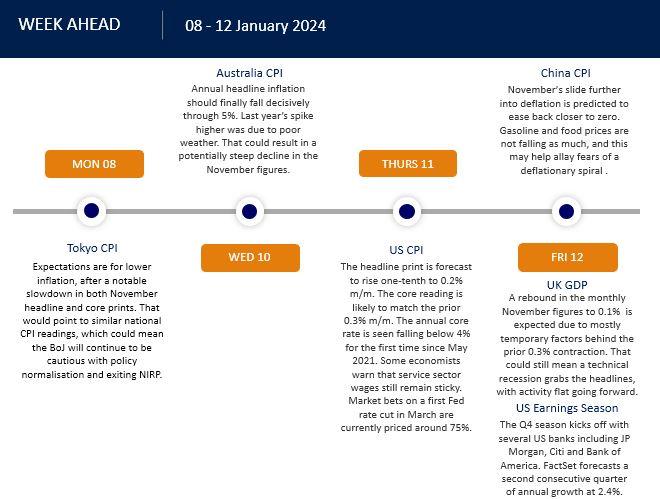

There’s a bunch of other inflation data from around the globe including releases from Australia and China. Any further dip into deflation in the latter in November is likely to intensify the downbeat risk mood that has seen US stocks turn red with their first losing streak in 10 weeks. However, this could also put pressure on the Chinese government to adopt bolder stimulus measures to support the economy.

Friday sees the start of the fourth quarter US company results season with analysts forecasting annual earnings growth again. Looking ahead, a longer-term poll from Reuters predicts that US corporate earnings should improve at a stronger rate this year as inflation and interest rates fall, though concerns surrounding slower economic growth cloud the outlook.

Here are the key events to watch this week: