Soft US economic data this week brought a setback to the soft landing narrative and beginning-of-the-year risk rally in stock markets. US retail sales have fallen by 1% or more in the last two months while both manufacturing and services sector ISM indices are in contraction territory. Investors will be nervously awaiting the first PMI readings of 2023 to get a handle on how much of an economic slowdown we might see in the months ahead. The global activity surveys are expected to continue showing weak demand, following on from the bad end to last year.

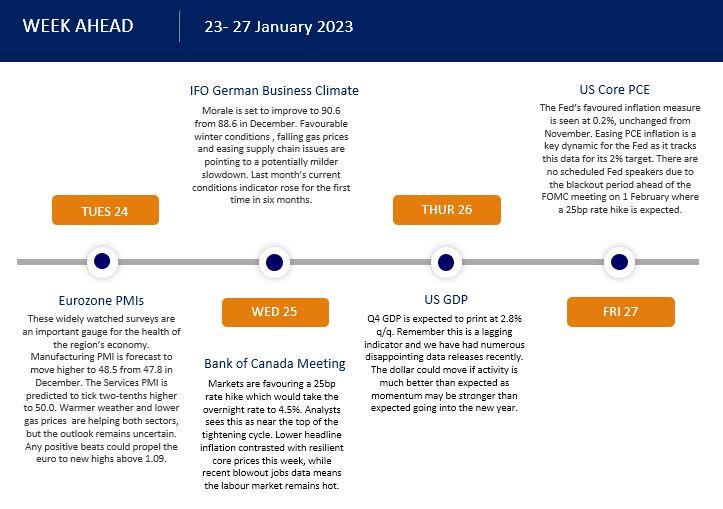

The first release of fourth quarter 2022 US GDP will grab the headlines. Estimates for the data are relatively upbeat at around 3% q/q annualised. Consumer spending is expected to remain a key driver given the strong performance in October. But the labour market may take a hit in the next few months with more high-profile job cuts being announced recently, by Google and Microsoft in the last week alone.

The latter release their Q4 earnings this week along with IBM and Tesla next week. In fact, 26% of the benchmark S&P 500 index report over the next five sessions. There will also be a growing buzz about the first week in February, when the other megacap tech titans like Apple and Amazon report their results. That week is building up to a big one for potential volatility with the FOMC, ECB and the Bank of England all meeting and making rate decisions within 24 hours of each other. Of course, we are closer to the end of the tightening cycle, so really the focus is now on possible rate cuts later this year.

The Bank of Canada meeting on Wednesday may point the way for those other central banks near peak rates. Policymakers are expected to raise rates for potentially a final time, taking the terminal rate to 4.5%.The red hot job market remains, but elevated core inflation continues to hurt the hard-pressed consumer. The loonie may be volatile as forward guidance by the bank will determine price action. If the bank is considering whether the policy interest rate needs to rise further, the CAD could move sharply with it struggling for most of this year already.

Here are the key risk events of next week: