It’s been another highly volatile week with choppy markets across asset classes. The midweek selloff in equities saw the benchmark S&P500 index clock its worst daily decline since June 2020. Corporate earnings from two of the biggest US retailers fanned the flames. The impact of inflationary pressures and ongoing supply chain disruptions on profit margins brought the outperformance of this sector to an abrupt halt.

One of the key questions for markets now is whether the consumer can hold up while broad-based price rises take effect. This is also the conundrum for policymakers and especially the Fed. Recession fears have hit the dollar recently, as the FOMC strive to achieve a “soft landing” by reining in inflation pressures without choking off economic growth.

A relatively hawkish US central bank should be seen in the FOMC minutes published on Wednesday. This will give us more clues on the Fed’s thinking on how to navigate future policy tightening in such an environment. It should also underpin support for the greenback after its first weekly drop in seven.

The euro and pound have eased from their oversold conditions. This is not surprising when you consider the latter had fallen over 10% from January’s high. The PMI surveys in both the eurozone and UK are expected to show warning signs of the high inflation environment. The long-term downtrend in both these major currencies still remains.

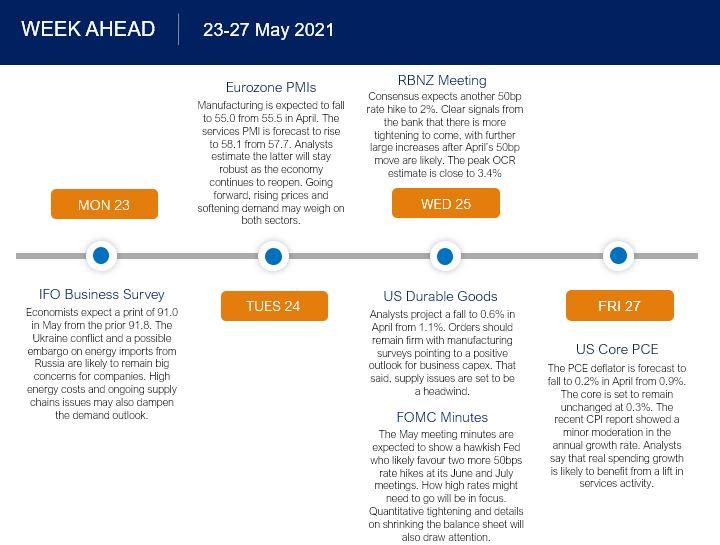

Here are the key risk events on the calendar:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.