Markets are leaning more and more to the Fed’s projection of three 25bp rate cuts this year. There are now just under 100bps of rate reductions priced in, which has been some adjustment from “peak policy easing” at the start of 2024 when more than seven cuts were predicted. Strong data including inflation and labour market figures have been at the heart of this move. And this week’s PCE inflation report is likely to further cement this theme, with the monthly print of the Fed’s favoured price measure remaining too high for rate cut chatter.

We should get a timely reminder of the strength of the US economy coming into 2024 with the fourth quarter GDP revision set to confirm the expansion of 3.3%. This blowout final three months of last year was above every single forecast in the Bloomberg survey ahead of the initial release. This growth may help underpin support for the greenback, which suffered its first losing week after five straight weeks of gains. But the dollar index is still trading above its 200-day simple moving average, and we will probably need to get concrete signs of slower, more benign, inflation to change this.

Interestingly, the widely followed US 10-year Treasury yield again failed to break above long-term resistance around 4.33% last week. This bond is seen a as global proxy for borrowing costs and turned lower on Friday, helping boost gold prices. After dipping below $2,000 a few weeks ago amid Fed policy uncertainty, gold bugs are hoping yields continue to drift down. The precious metal tends to be more attractive to investors when interest rates are lower, as it doesn’t offer any yield. But central bank buying remains strong and comes as countries like China shift reserves away from US dollars. Strong retail demand in India and other emerging markets could also help prices push higher over the medium-term.

Other important data to watch out for this week includes Eurozone inflation. It is expected to be relatively well behaved on a monthly basis in the core, which the ECB is monitoring closely. Markets also get the region’s unemployment, which remains at record low levels at 6.4% despite economic stagnation. This is feeding into wage growth which is the real concern for policymakers. An upside surprise here would help the doves and potentially hurt the euro as it tries to steady above 1.08.

China PMI manufacturing is expected to come in below the critical 50 threshold for the fifth month in a row. But a solid recovery in travel over the Lunar New Year should keep the service sector print above 50. Can Chinese stocks build on their strong week after a very volatile start to the year? This was exacerbated by the “quant quake” when quant models at funds failed and caused forced selling and a sharp decline. Fresh record highs in the US and European stock markets give some encouragement, and perhaps prove that the risk rally may not just be about seven stocks in the US.

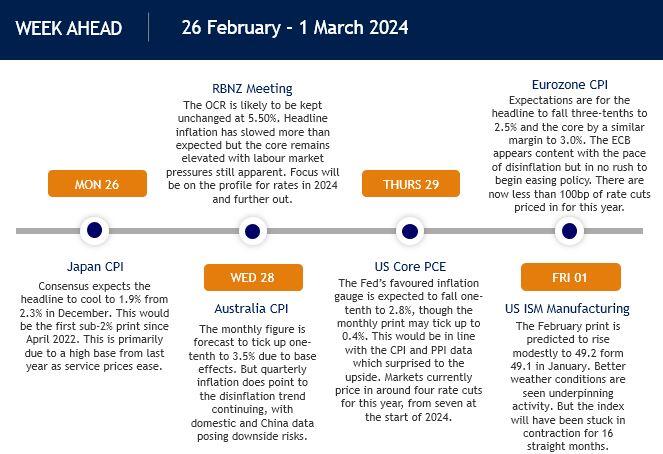

Here are the data highlights: