Next week’s highlight is the monthly US jobs report which is expected to remain buoyant. Once again, it is the lack of worker supply that is the crucial problem with nearly two vacancies for every unemployed American. In turn, this tightness is likely to bid wages higher. Going forward, the pace of the increase in hourly earnings may slow which means real incomes will fall through 2022

The firm jobs market should offer some support to hawkish expectations, the consumer and the dollar. A weaker than expected report would see the greenback sell off and risk markets go higher as it is more likely there will be less need for aggressive action by the Fed. As policy tightening takes effect, jobs growth should slow, and together with strengthening participation, that may signal a likely low in the unemployment rate at 3.5%.

Last week saw the overbought greenback fall for a second consecutive week, the first time this has happened this year. Markets are still set on two 50bp interest rate hikes at the next couple of FOMC meetings. However, it is what happens beyond this and the summer which should determine dollar direction. Policymakers will have a raft of the latest data to assess and decide if additional big rate moves are required. Traders are looking to see if the economy is rolling over, with softer data now printing more frequently.

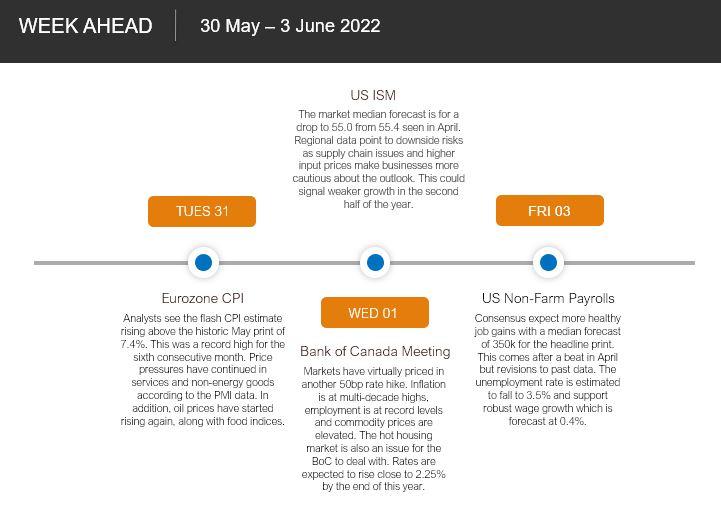

Another half point interest rate hike by the Bank of Canada is forecast on Wednesday at its policy meeting. The CAD has been the second best performing major currency this year, after the greenback. A hawkish central bank suggesting more 50bp rate moves in the upcoming months is expected to underpin the loonie, especially against those lower-yielding currencies which are shifting monetary policy at a slower rate.

Here are the key risk events on the calendar:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.