It's another busy week ahead with the first Bank of Japan meeting of 2023 being a key focus for markets after the shock widening of the yield curve band just before the festive period. This was despite potentially weakening the credibility of its current monetary framework and expectations that inflation will fall below the 2% target in 2023. Speculation is rife that policymakers may increase the yield strategy further.

The market smells blood and has pushed the 10-year yield to the new upper bound and bought the yen aggressively over the past few weeks. USD/JPY is down over 3% already this year. But the major may need more than the expected new higher inflation forecasts that will be released midweek to keep the bearish momentum going in the near-term. Major support/resistance sits at 128.16 which is a long-term Fib level of the 2022 rally.

The dollar has taken a beating to start the new year with a technical breakdown below 103 on the DXY. The strong selling seen in the last quarter of 2022 has carried over with the recent inflation data endorsing the step down to a more traditional 25bp Fed rate rise in February. Price pressures are still elevated and way above the FOMC’s target of 2%. The jobs market remains tight, and the unemployment rate is now back at a multi-decade low. But Fed speakers who have consistently banged the drum about keeping rates high for longer are having a tough time being heard at present. Next week’s data flow includes activity numbers like retail sales which could highlight softer consumer activity. This kind of data won’t help the greenback which looks prone to more weakness.

We get the usual mid-monthly data dump in the UK which should go some way to deciding if the Bank of England hikes by 25bp or 50bps at its meeting next month. Last week’s better-than-expected GDP figures will probably mean the economy will skirt a recession in the fourth quarter. Going forward, pay growth still looks relatively strong with the jobs market continuing to show little sign of deterioration. Inflation has peaked but is likely to remain in double digits for the next few months. This resilience may give the MPC a bit of room to manoeuvre as it hikes rates next month.

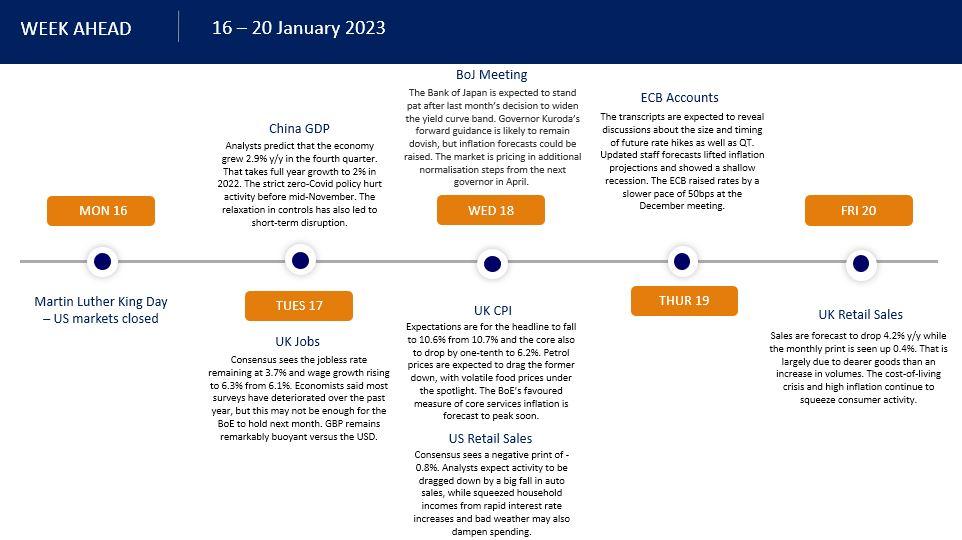

Here are the key risk events coming up: