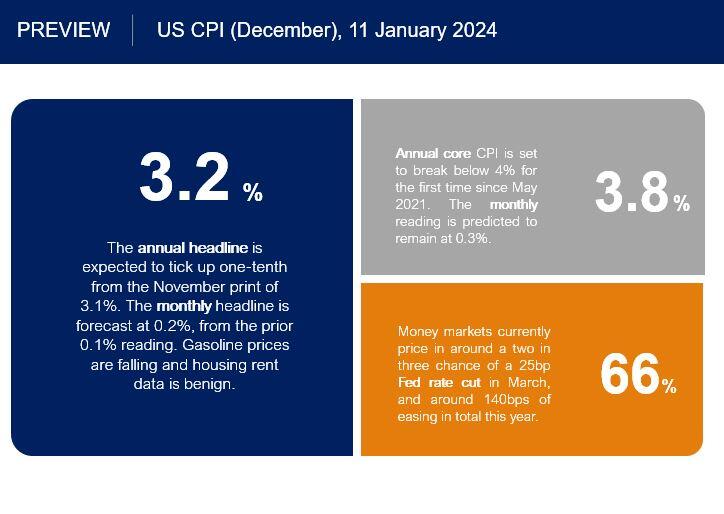

Tomorrow sees the big risk event of this week, US inflation, which is expected to show a soft print for the month due to easing gasoline prices and housing rent. The Fed’s favoured inflation gauge, the core PCE deflator, has been printing lower readings than the CPI over recent months and this is likely to be seen in the consumer basket.

Policymakers seem to be more comfortable with the path of falling prices judging by the recent FOMC minutes. They see risks as diminished and that was a key reason for the lower path for the Fed funds rate in 2024 including an extra 25bps rate cut, so 75bps in total for 2024.

Friday’s non-farm payrolls report gave us mixed signals about the world’s biggest economy. But solid employment gains, low unemployment and sticky wages generally point to no immediate need for Fed rate cuts. But the job market is certainly cooling while last week’s ISM Services data was more dovish with prices, new orders and employment all softer than predicted.

Dollar bounce

It’s been a relatively quiet week with volatility likely to pick up with the CPI data. The release could see currencies move out of their current choppy and sideways trading ranges. Focus will also be on a bunch of US bank earnings released on Friday which kick off the fourth quarter results season.

Last year’s late sell-off in the dollar has abated for now. This is down to a mild reassessment of all the interest rate cuts expected by markets from the Fed in 2024, starting as soon as March. Those bets have fallen from above 85% a few weeks ago to the current 65%, while the total number of rate cuts this year has fallen to under six 25bp moves.

Policy easing by the Fed and the fall in Treasury yields had seen a strong bid to stocks and risk markets through to December, as investors cheered hopes that the Fed’s tightening was done and a potential pivot to rate cuts would take place soon.

Market Reaction after rangebound trading

The Dollar Index has had a series of similar closes over the past few sessions around 102.50. If we ignore the wider ranges on the release of last week’s NFP data, generally the more prices contract in narrow trading ranges, the bigger the eventual range breakout could be.

A “death cross” has formed on the chart. That is when the 50-day simple moving average crosses below the 200-day simple moving average and is generally seen as a bearish signal. A weaker than expected inflation report would potentially see dollar selling and a fresh bid to stocks and gold.

Here are the numbers expected for the US inflation release: