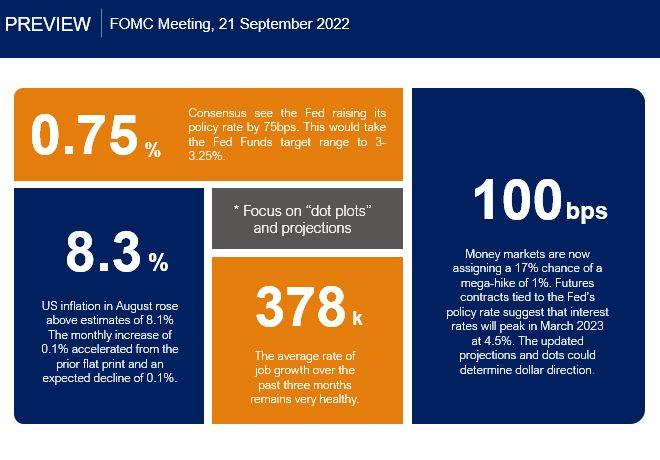

It’s an incredibly busy week full of central bank meetings and headlined by the US Federal Reserve. Their interest rate decision is set to be announced on Wednesday at 18.00 GMT. After last week’s hotter-than-expected inflation data for August, money markets have priced in just under a one in five chance of a monster full percentage point rate hike. A more likely 75bp move would still be the third in a row. Much focus will be on the new projections and “dot plot” which should highlight how Fed officials view the evolving economic cycle.

The Fed is squarely focused on showing off its inflation fighting credentials, even if it means growth will be hurt. That does mean a 100bp rate hike would be a clear signal by policymakers that they are determined to bring down price pressures by front-loading interest rate rises.

On the flip side, it seems more probable that a move of this size would unnerve Wall Street. Panic could seep into certain parts of the market and also raise the prospect of the Fed tightening policy too much. This would then reduce the chances of a “soft” landing. This means “just” another 75bp rate hike may be a slight disappointment unless it is later accompanied by a more hawkish Powell and press conference.

Aside from this meeting’s rate increase, markets will focus on the statement language and the latest Summary of Economic Projections. They were last released in June, so investors expect lower growth forecasts, higher inflation estimates and Fed funds rate projections. The latter are the “dot plots”, shown on a chart that indicates each Fed official’s prediction for the bank’s short-term interest rate. If these point to a peak near the market level of 4.5% in the first half of the year and no cuts for the rest of 2023, the dollar rally could enjoy another leg higher.

Here are the numbers to know ahead of the meeting: