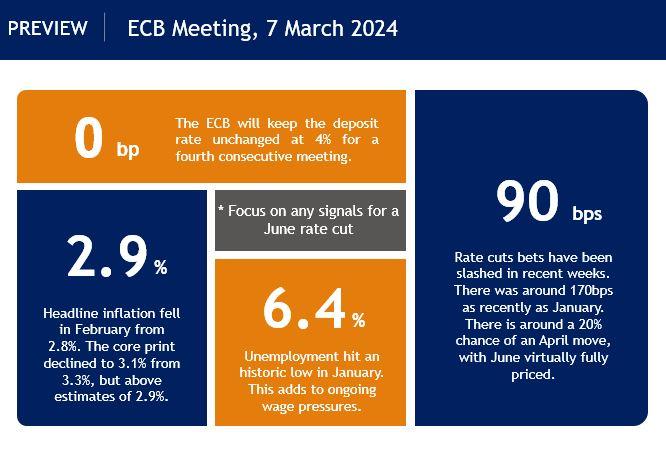

Thursday’s ECB rate decision is fully expected to leave policy measures unchanged for a fourth meeting in a row. Officials have continued to push back expectations of an early rate cut, while emphasising the significance of Q1 wage negotiations and that decisions will be data dependent. The results of these won’t be released until after the April ECB meeting. Fresh economic staff projections will also be released, which are predicted to be revised lower for growth and inflation. This all points to a first rate cut in June, which is what markets are currently pricing in.

The eurozone economy appears to be in stagnation mode, having avoided recession so far. The latest composite PMI ticked up modestly to 48.9 from 47.9, but still remains in contraction territory. This was boosted by the services sector which climbed to 50 for the first time since July. Inflation expectations are anchored while core inflation is falling but still sticky above 3%. Alongside record-low unemployment, there are hopes this sets the scene for a gradual rebound in growth through 2024.

Focus on new economic forecasts

The new staff projections, released every quarter, will be key. GDP forecasts are expected to be reduced, which could push the jobless rate higher in time, implying slightly weaker wage and price pressures. Inflation projections are likely to hit the 2% target in both 2025 and 2026. for the first time in this hiking cycle. That would ordinarily keep the next meeting in April live, with the prospect of a rate cut on the table.

However, the poor performance of previous inflation projections especially, has led some Governing Council officials to question their reliability. This also tallies with members wanting to have sufficient confidence in the forecasts which point to the 2% inflation target. Furthermore, President Lagarde may still highlight upside risks to the outlook due to the uncertainty around wage growth. This has been an important factor for the ECB due to the resilient job market, accelerating earnings and solid level of savings.

Doves and Hawks vocal

Recent comments from ECB officials continue to point towards no imminent intention to lower rates with President Lagarde observing that the ECB is “not there yet” when it comes to inflation. Even the doves have avoided fuelling rate cut expectations, with more time and information wanted to ensure price growth is heading back to target.

Of course, the hawks have generally turned more explicit in dismissing prospects for an early rate cut, with caution around lowering rates too early and a higher for longer rates setting preferred ahead of increased confidence on the disinflation trend.

Market pricing and reaction

Following the January ECB meeting, pricing for rate cut max’ed out with 150bps worth of policy easing for 2024. But these odds have been slashed more recently, with money markets currently pricing in around 90bps. Theres is a small chance of a first rate cut in April, but a 25bp reduction in June is nailed on.

It would appear the most at the ECB are more comfortable with this current pricing. A cautious, wait-and-see mode seems credible with Lagarde keen to see how wages and more data play out. If the projections show that headline inflation is very close to target by the end of this year, then the ECB likely won’t upset the market.

Here are the key numbers to know ahead of the meeting: