Thursday’s ECB rate decision is set to be a formality with the bank leaving policy measures unchanged for a third meeting in a row. But while rate cuts are expected by money markets soon, a chorus of ECB officials have been setting out their views in recent weeks. The overall message appears to be that it is too early to declare victory on inflation and by extension, cuts will not come as soon as markets hope. That means President Lagarde is likely to stress that the bank remains in data dependent mode and will try to avoid any guidance on rate cut timings.

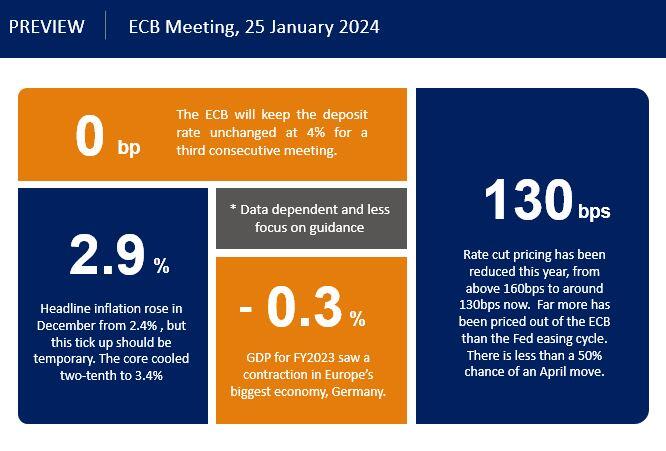

Data since the last meeting in December has been sparse. While headline inflation ticked up due to specific factors, the more important core rate continued lower. Indeed, the most recent bank projections unveiled at last month's meeting plot headline inflation easing this year to an average of 2.7% and then falling to 2.1% and 1.9% in 2025 and 2026, respectively. Other activity data like the PMI surveys show that the region’s economy remains stuck in stagnation, with ongoing weakness expected in the updated figures released tomorrow.

Market pricing still diverges from ECBSpeak

One major theme of the new year has been the reining in of rate cuts that were priced in by money markets towards the end of 2023. That outlook for aggressive policy easing has been pushed out. Investors now expect around five to six rate cuts this year, with the first move in April given just less than a coin toss chance.

Recent communication from the governing council suggests that members mostly prefer to wait for the results of wage negotiations after April, before reducing policy rates. Both President Lagarde and Chief Economist Lane have pointed to June and the summer when the bank will have more data. But as is usual with the ECB, opinions are wide ranging with some signalling cuts could come sooner, while some hawks believe 2025 is more appropriate.

FX impact could be limited

With recent data limited and broadly in line with the ECB staff projections, the near-term influence of the meeting on the euro might be relatively quiet. Unless President Lagarde offers clarity on the timing of rate cuts, EUR/USD could be driven more by broader market risk sentiment. Going forward, upside risks to US inflation and more weak Chinese data could weigh on the major. The flip side would be a major repricing in ECB rate cut expectations which would underpin support for EUR. A big China stimulus package would help.

Here are the key numbers to know ahead of the meeting: