The Bank of Canada is expected to leave rates on hold today at 1400 GMT. Simmering trade tensions will most likely offset the rebound narrative we have seen in domestic economic figures. This means a neutral line is likely to be taken by the bank.

At its previous meeting, the central bank removed its modest tightening bias and downgraded its 2019 growth forecast based on its prediction the economy nearly ground to a halt at the start of the year. The bank also appeared to be in no hurry to move interest rates any time soon because, unlike its recent statements, the April announcement made no mention of a need for future increases.

The focus today will be on any new policy signals and the bank's forward looking language. Although no significant news is forecast, there is the potential for a moderately stronger CAD with an 'on-hold' announcement. Governor Poloz has been more optimistic of late and the lifting of steel and aluminum tariffs should bolster policymakers’ confidence in the economic outlook, and specifically business investment.

Domestic rate expectations have seen a sizeable adjustment over the past two months. The market had priced as much as 30bps in BoC easing (over 12 months) as recently as March 27 and had been pricing about 20bps of easing into the last policy decision. This easing bias has been almost completely eliminated with bets for a rate cut now roughly even odds by December.

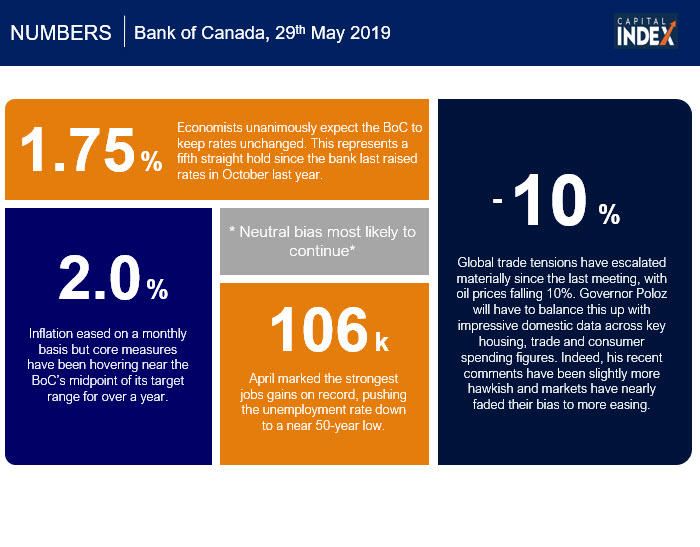

Here are the numbers to know ahead of the meeting:

FX Outlook

We are awaiting a break of the mid 1.33/lower 1.35 range from late April. Very strong resistance is at 1.3521, the cycle high that has been tested and held on numerous occasions. Given the market's persistent dovish lean, a neutral statement may be viewed as somewhat hawkish, which would see declines to near-term support at 1.3430. Further below, 1.3380 and 1.3274 offer longer-term support.

Conversely, if the bank focuses more on downside risks and global trade issues, a break through 1.3521 would quickly see 1.3560 and then 1.36.

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.