After a chaotic week of central banks meetings and blockbuster economic data, the risk calendar looks relatively light in the near term. The rate hike announcements by the Fed, ECB and Bank of England were expected but what they said didn’t convince markets a great deal at the time. The big kicker was Fed Chair Powell’s dovish press conference which sparked a strong rally in risk assets and bonds. He speaks at a conference in Washington overnight on Wednesday where he has the opportunity to clarify his stance. Most expect the Fed Chair to push back against the market reaction of buoyant risk assets after an eye-wateringly strong NFP report and ISM Services print. If he doesn’t, the implication would be that the FOMC remains relaxed about the easing in financial conditions and that rate cuts this year are justified.

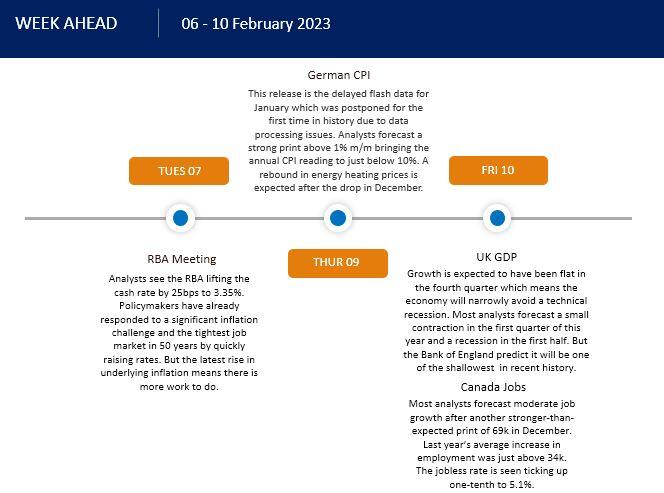

The RBA meeting on Tuesday is expected to see another rise by 25bps taking the cash rate to 3.35%. The bank has already lifted rates at each of its monthly meetings, including four 50bp hikes from June to September. The RBA then slowed the pace of tightening in October and pivoted to 25bp hikes with policy arguably in contractionary territory. But the recent inflation data showed that underlying CPI had risen to 6.9% from November’s print of 6.5%. This is clearly going the wrong way for policymakers and more work needs to be done.

Looking ahead, forward-looking indicators are softening with house prices continuing to cool and the full impact of the RBA’s rate hikes still to be felt. The AUD made new cycle highs last week at 0.7157 versus the US dollar but the major plunged after the blockbuster US employment report. Prices have dipped below last week’s low at 0.6983 and next support sits at the halfway point of the 2022 decline at 0.6915.

Here are the main risk events on the calendar: