Amongst all the political, geopolitical and central bank meetings that have taken place this week, we still have the monthly US jobs report (every first Friday of the month) to look forward to and traders will be as focused as ever on this release.

Job creation in the US has been slowing since the second half of 2018, with the monthly average for this year generating around 165k jobs per month. This is still ahead of the monthly pace necessary to keep the unemployment rate steady but has decelerated from the 200k over the last eight years.

We note that the escalation in the trade war with Trump’s tariff announcement at the start of August may have negatively impacted hiring confidence on the path to the nonfarm reference period. That said, with initial jobless claims near their cyclical low and jobs reported to have been plentiful in the Conference Board’s consumer confidence survey, the labour market is expected to remain fairly healthy in this report.

With unemployment stabilising around 50-year lows, the tight labour market should be enough to sustain growth in wages above 3%. However, base effects and moderate monthly gains may have an effect on the annual earnings reading.

Global risk sentiment has turned more positive this week with trade tensions abating. This has seen a steep sell-off in the dollar, having made new multi-month highs on Tuesday. For this to continue, we would need to see a sharp slowdown in the labour report as this could then prompt the Fed to reconsider easing merely being a ‘mid cycle adjustment’. Conversely, a strong release will be bullish for the buck and see yields move higher.

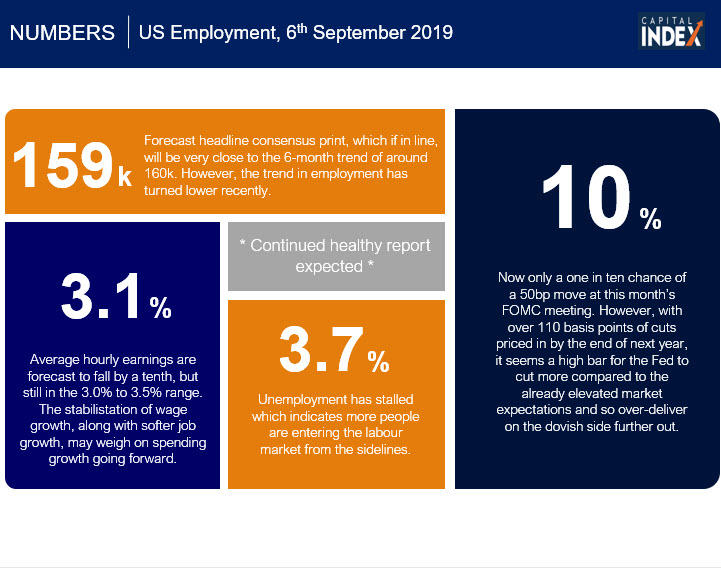

See below for the key numbers to know ahead of the jobs release tomorrow at 13.30pm (GMT+1):

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.