The first Friday of June brings with it the release of US employment data, including non-farm payrolls and average hourly earnings which are always eagerly anticipated, but even more so with the highly data-dependent Federal Reserve.

It seems Powell and his colleagues had been concerned recently by their failure to ratify market rate cut expectations as this could have seen a reversal of desirably low rates. In which light, the Fed Chair signalled on Tuesday that it may be prepared to cut rates to sustain growth. His comments were then echoed by his number two, Clarida, who said if the central bank senses growth slowing, they will act to maintain growth at potential.

This is certainly a dovish tilt from the previous message from the last FOMC meeting which stated that the Fed didn’t see ‘a strong case for moving in either direction’ on rates.

Regarding the data releases, we’ve had mixed signals for employment so far this month. ADP Private sector jobs printed the fewest since 2010 whilst the service-industry gauge topped forecasts amid a rebound in employment. We think it’s important to note that a major reason why jobs growth is moderating in the US may be due to a shrinking pool of available labour, not because job openings don’t exist.

This should ordinarily exert upward pressure on wages which in turn may cause some re-pricing of the 'overpricing' of the Fed rate cuts, as Goldman Sachs has labelled it, and a bounce in the dollar.

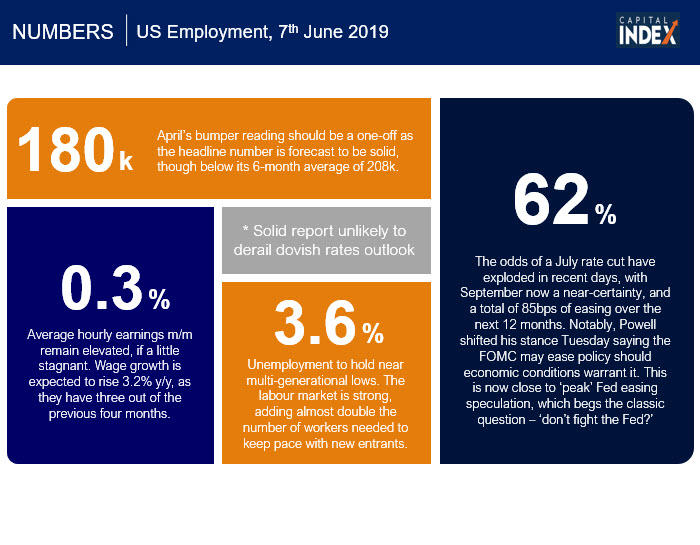

See below for the key numbers to know ahead of the release tomorrow at 13.30pm (GMT+1):

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.