It's is an exceptionally busy start to the month with key data releases, central bank meetings and a host of Fed speakers to focus on, including Jerome Powell on Tuesday.

With current global tensions in markets elevated, all eyes will be on whether the fed Chair and the other speakers across the week signal increased concern toward the economic outlook which could bring forward rate cut expectations that are already a 50–50 market bet for the July FOMC meeting.

The entire US yield curve is now trading below the Federal Funds rate, except for the 30 year bond which is only a handful of basis points away. With the S&P 500 having its first monthly loss in 2019 last month, albeit having reached near all-time highs in that time too, it will be fascinating to see how the Fed now view circumstances in the wake of the threatened tariffs against Mexico which could signal somewhat greater unease going foreward.

The ECB is expected to leave rates unchanged and publish new growth and inflation forecasts, as well as details of its new subsidised funding stimulus (Targeted Longer-Term Refinancing Operations - TLTROs). Alot has happened since the last macro projections, so potential downgrades and a heightened awareness of external risks could force the euro out of its trading range.

The market is fully expecting the RBA to cut rates to 1.25%. All inflation measures are tracking well below the target 2-3% range and unemployment has ticked up since Governor Lowe openly stated that the RBA “will consider the case for lower interest rates”. Markets are primed for about a one-in two chance of a further rate cut in July with a 40% chance of a further cut in December. The release of Q1 GDP, which is expected to fall below 2% y/y for the first time since Q2 2013 comes after the RBA announcement.

Finally, the first Friday of the month brings US employment data. Non-Farm payrolls always fascinate traders but with the Fed on hold (or “patient,” as they would say), the hurdle for any change in policy is much higher than it used to be. Of course, 'Fed-speak' mentioned above may influence this position to some degree...

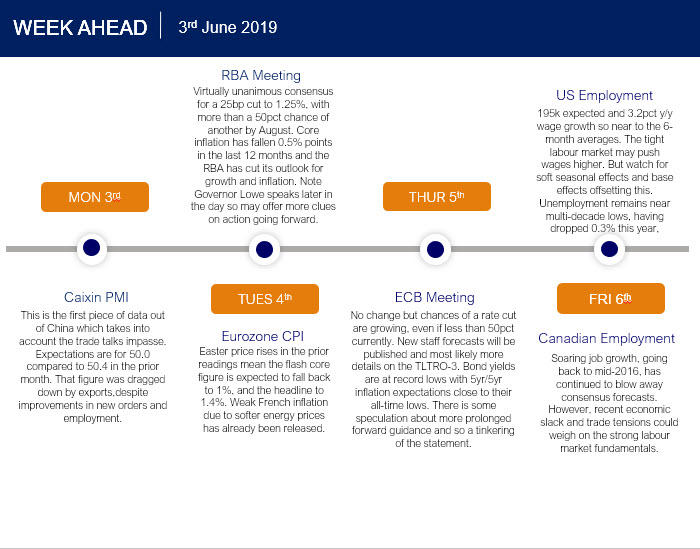

Here's what to look out for on the calendar across global markets this week:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.