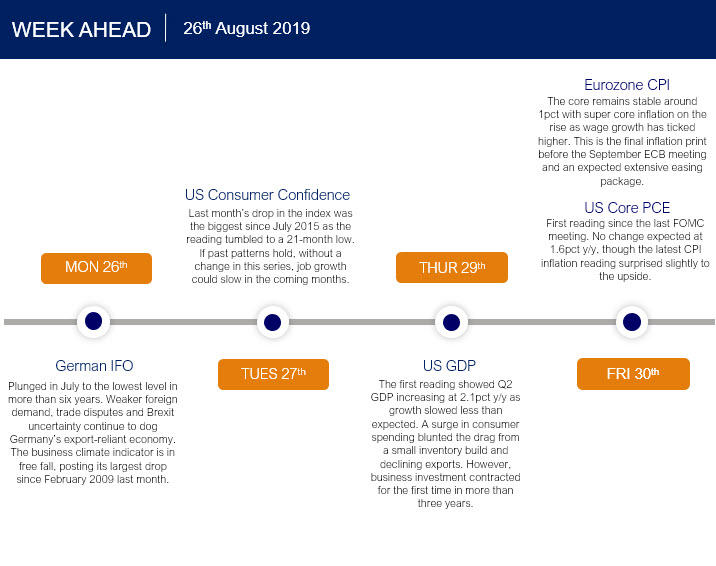

This week's calendar sees the release on Friday of the last eurozone inflation print before September’s ECB meeting, setting the scene for the expected monetary stimulus package. Inflation has been falling recently and with the core print stuck around 1%, the July release will likely bring more ammunition to the doves

German economic data is also not expected to bring any positive surprises with the main business index (IFO) set to fall further on the back of ongoing geopolitical uncertainty.

Stateside sees the Fed’s favoured measure of inflation, the PCE data, also released on Friday. The core inflation rate is expected to be unchanged at 1.6%, although there is a chance we could see a small tick up, similar to the CPI print which was driven by higher goods inflation.

We also get a consumer confidence reading, Q2 GDP print and preliminary capex orders for July. These latter figures may be interesting in light of the ongoing manufacturing slowdown and trade war uncertainty.

UK MPs will return from their summer sojourn next week so we will be on the look out for some clues on how MPs plan to use the first couple of weeks back after summer as the battle to avert a ‘no deal’ Brexit on 31 October begins.

Here's what's on the calendar across global markets this week:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.