Stock markets enjoyed the better than expected US Q1 GDP Friday ending the week on a strong note. The US economy grew 3.2% in Q1, the best start to a year since 2015. The print topped estimates of 2.3% and Q4’s 2.2%.

Macro data risk wil be very high as we have a packed calendar full of central bank meetings and important economic figures, so adjust position sizes accordingly. Trade headlines may also dominate in the first half of the week as US-China trade talks recommence tomorrow.

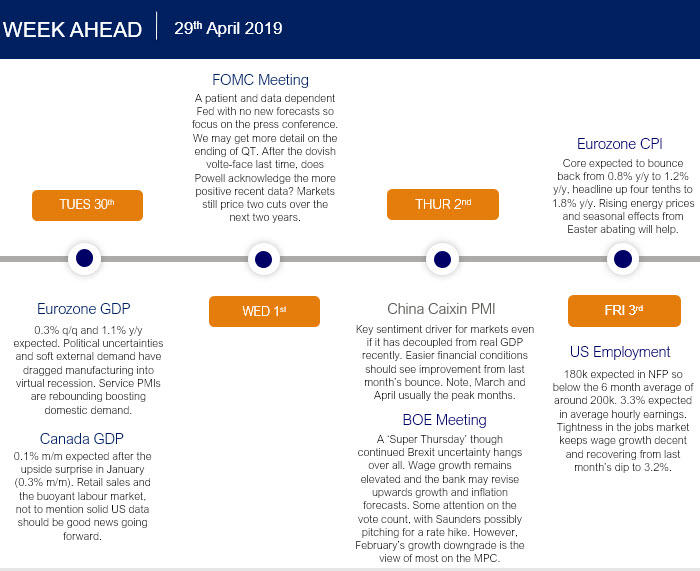

Key questions for the main risk events will be whether the FOMC can sound optmistic without sounding 'less' patient. Will the risk of at least one vote for a hike at the BOE Meeting Thursday send too hawkish a signal? And rounding off the week, will record low jobless claims see another impressive US jobs print?

The strong weekly close on DXY for the dollar is noteworthy with EUR/USD remaining below previous lows around 1.1180. Interestingly, bond markets remain extremely sensitive to disappointing data while showing resilience to exceptional positive surprises. Watch out for potential heightened volatility in Asia due to the ten day holiday in Japan.

Here's what to look out for on the data calendar across global markets this week:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.