After the pyrotechnics of the ECB meeting, we have a deluge of central meetings this week with the Fed taking centre stage. We also get inflation data from a number of countries as well as China releases which are expected to show some improvement from previous readings.

The main event of the week will see the Federal Reserve cut rates once again by 25bp. Higher trade uncertainty and slower global growth have worsened since their July meeting, while the August inflation report surprised higher and probably invigorated more hawkish FOMC members. With a rate cut more or less priced in by the market, the words of Chair Powell and the outcome of the dot plot chart will likely be what determines market reaction.

The Bank of England remains in Brexit limboland with a combination of a tight labour market, trade war uncertainties and slowing global growth. The chances of a 'no-deal' Brexit have receded and Monday's meeting between PM Johnson and EU Commission President Juncker , their first tête-à-tête since Johnson became PM in July, will grab the headlines.

We've seen some positive signs from both sides over the past week in the trade war, ahead of the high-level talks in early October. There will be lower-level preparations for the talks next week, which may lead to some comments from the US and China ahead of the important negotiations in next month.

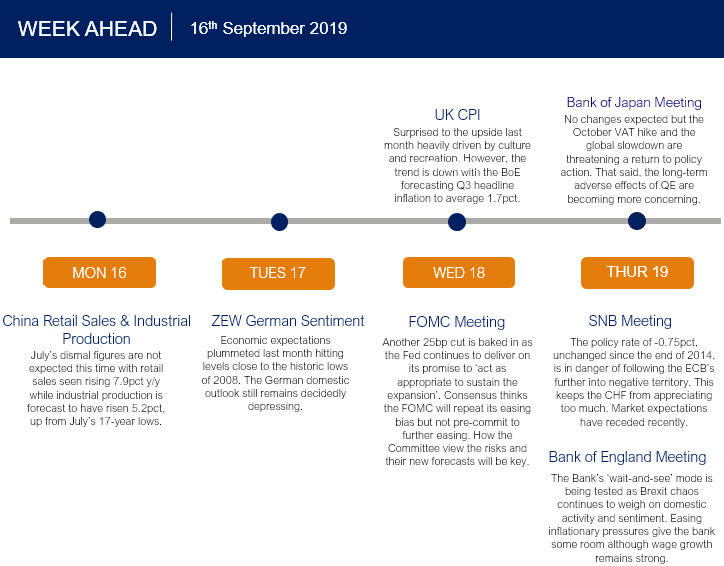

Here are the key events on the calendar across global markets this week:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.