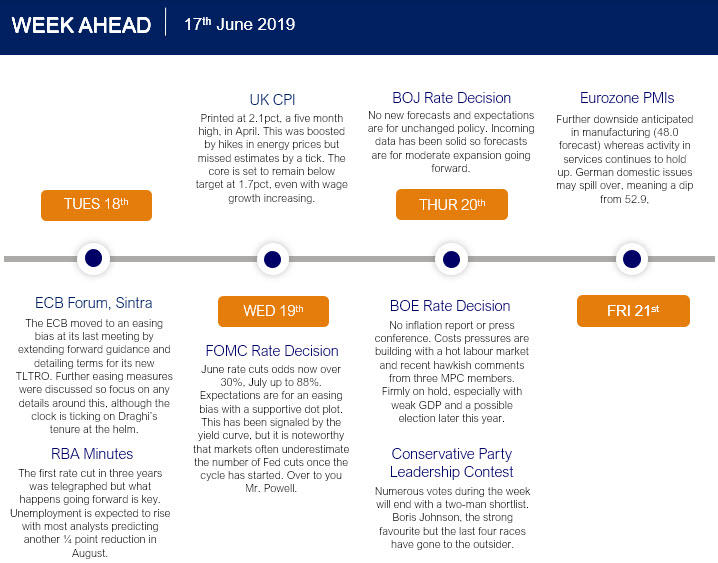

We have numerous central bank meetings this week, including the Federal Reserve, Bank of England and Bank of England. The annual ECB Summer Policy Forum at Sintra in Portugal kicks off the week, whilst the ongoing soap of opera of the Conservative Party leadership content climaxes on Thursday when ten becomes two.

As calls for monetary policy easing get increasingly louder, the Fed is expected to make a dovish policy shift at its meeting this week. With a statement, updated economic projections and a new 'dot plot', a July interest rate cut signal, at a minimum, is expected.

Can Jerome Powell afford to disappoint markets (and a President) baying for rate cuts? Expect downard revisions to the 'dot plot' and language explicitly pointing to near-term action. A 'patient' FOMC is no longer warranted as the markets see it and any mention would be a severe shock with almost three full cuts priced for this year.

Other central bank meetings will probably be less impactful but still followed intently as both the BOE and BOJ are firmly on hold. The latter are seemingly running out of effective options to loosen monetary policy, as a move towards the inflation target of 2% has failed for many years. However, October's VAT rise may seriously dent consumer demand and force Kuroda's hand in some way, given that previous tax rises were soon followed by recessions.

The BOE meeting will most likely be overshadowed by the Conservative leadership party contest with the contenders Brexit policies being analysed intently as numerous ballots take place this week. The Halloween deadline for a deal with the EU gets ever closer with risks of a hard Brexit, delay, renewed negotiations and a general election still possibilities.

Finally, we start the week with the ECB Forum with traders on their guard for any market-moving comments by Mario Draghi. He certainly has history at this event with his assertion two years ago that 'the threat of deflation is gone' sending the euro soaring. This time around, many are questioning whether the central bank has the scope to unleash another round of monetary stimulus, especially with Draghi stepping down in October.

Here's what to look out for on the calendar across global markets this week:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.