The week's highlight, the month's highlight in fact as we've had such a long build-up to it, will be the meeting between President Trump and Xi at the G20 gathering in Osaka, Japan. Even a side meeting between the North Korean 'Rocket man' and Trump will be overshadowed.

Having ratcheted up tensions in the trade war last month, President Trump is supposedly meant to have initiated the phone call to Chinese President Xi Jinping in order to get the meeting organised, which is set to take place after the official G20 rendez-vous is over on Saturday. Does this signal some sort of enthusiasm on the part of Trump to repair the relationship with a view to hatching a deal in the longer-term? It is unclear if we will get any messages before the weekend, or we will have to wait until Friday or Saturday, which means the Asian market open next week will be hugely significant.

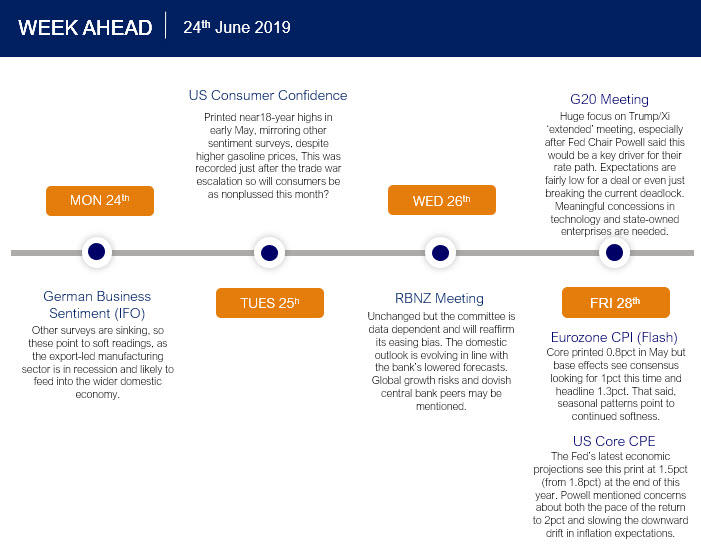

More immediately, the bar is low to what many are expecting. Perhaps the best outcome is a restart of trade talks and any further escalation is avoided. As Fed Chair Powell said last week, trade has been "an important driver of sentiment" so the outcome of this meeting will effectively determine whether the Fed jumps in to ease policy as soon as July and also to what extent.

The dovish shift, by both the FOMC and Mario Draghi, will mean attention is on inflation data across the pond and in Europe. Powell no longer believes that inflation is transitory and sinking long-term expectations are currently taxing all central bankers. Similarly, European markets will focus upon another batch of inflation readings for June. They may further inform expectations for potential ECB policy actions.

The Reserve Bank of New Zealand will keep policy rates unchanged at 1.5% at its meeting. Weak economic data have recently indicated that we could see another OCR cut soon, following the May cut, with markets pricing in over a 70% chance of a move in August.

Here's what to look out for on the calendar across global markets this week:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.