A relatively light event calendar can be deceptive, especially in these Summer months, when many market participants and traders are on vacation. However, don’t be fooled as ongoing trade tensions and global growth worries are ever-present and have sparked some volatile moves in markets.

Treasuries had their biggest monthly rally in more than four years last week as bond markets have sounded a recession warning, with ratings agency S&P warning investors it is on ‘high alert’ for the US economy. The yield curve - the market's expectations of future interest rates - inverted for the first time since the summer of 2007 and we wrote about this last week in more depth here.

We have an interesting week ahead of us, as we get more colour on the US macro outlook with the release of manufacturing PMI which is expected to fall below the 50 threshold in line with the global weakness in manufacturing.

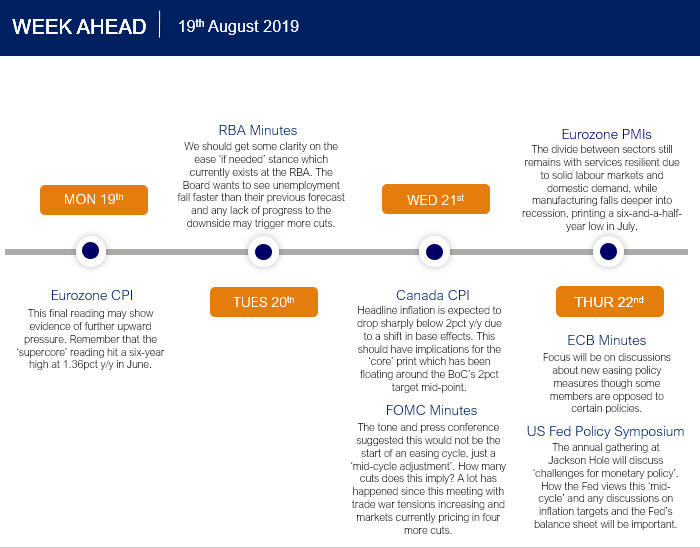

Wednesday’s FOMC Minutes may appear rather stale, and hawkish as alot has happened since the Fed’s ‘mid-cycle adjustment’. Chair Powell’s press conference suggested this would not be the start of an easing cycle but less than twenty-four hours later, Trump made his announcement that he would apply a 10% tariff on $300 billion of Chinese imports. Markets are currently pricing in nearly four more cuts in addition to the one already delivered with investors placing odds of 21% on a half-point cut in September.

In Europe, the ECB will publish an account of its July policy meeting on Thursday after changing its rates guidance to suggest that rates could be cut soon. A power struggle is occurring in Italy’s government and the drama will continue with an expected vote of no confidence in Prime Minister Conte.

The main draw of the week will be the Federal Reserve’s annual symposium at Jackson Hole, taking place from August 22-24. Numerous central bankers will be attending, including Powell who is scheduled to speak on Friday, when we may get an update from him on how he sees this ‘mid-cycle’ and whether the Fed moves more swiftly and aggressively owing to the recent increase in trade tensions.

Here's what to look out for on the calendar across global markets this week:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.