We touched on the low volatility in FX markets last week and there remains some unease among experienced traders that the situation reflects a heightened state of market complacency. Although this sort of situation has no specific time limit, traders must always be aware of key technical levels in the market as a catalyst can trigger a reversal at any time which means we can be more confident when volatility does pick up. No where is this more true than in the world's most heavily traded pair, EUR/USD.

Fundamentals

What is especially interesting for us is that for all the downbeat data and dovish talk from Mario Draghi, it is clear that the single currency is still very well supported, finding strong buyers on any dips. Indeed, we got more of this gloomy central bank speak yesterday when some ECB policy makers stated they were sceptical of the economic rebound scenario in the second half of this year, a view that is central to the bank’s overall outlook. The report also suggested that policy makers were not in favour of tiering for the deposit rate which confirms our view that much of the speculation before last week’s ECB meeting was wide of the mark - this really is a ‘last resort’ option in the ECB’s monetary easing toolbox.

On the flip side, the Federal Reserve remains on the sidelines with anchored US rates and an Administration which is keen to see a softer greenback, whilst talking tough on trade. With some green shoots appearing in the eurozone growth outlook, a lot of bad news already seems to be factored in to the exchange rate at current levels. It is also worth noting that the gross short position in EUR amongst speculative and commercial traders in the weekly futures positioning report is extended and pushing toward the record level reached in 2015.

Technicals

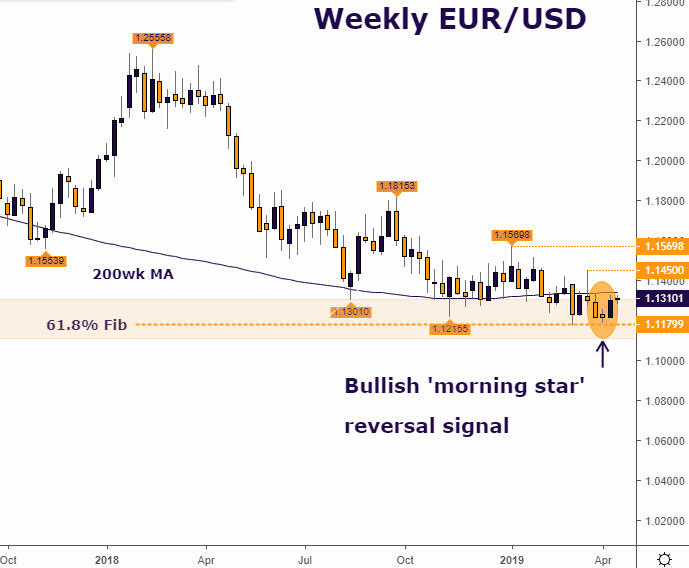

Low volatility in the euro is especially relevant as we have seen choppy sideways price action for some five months now in EUR/USD, which is the longest trading range in two years. We find in this type of environment, it is useful to look at longer timeframe charts in order to give us a wider technical overview. So, it is instructive that prices have been well supported at a key Fibonacci level (61.8%) of the 2017-2018 low to high move and a bullish breakout zone from 2017. We also closed firmly last week after the ‘dovish hold’ by the ECB and formed the third leg of a bullish “morning star”. This is a rare reversal pattern that can offer a strong bullish signal and should in the short-term further cement support in the 1.12 region. We are now watching for additional bullish price action with the greater risk from here it would appear, for the formation of a meaningful higher low.

Near-term, EUR/USD has been struggling to extend above 1.13 but a push above here can lift the single currency potentially above the 200-week Moving Average around 1.1340. Major resistance remains at 1.1450 before we see this year’s highs around 1.1570. Key support comes in at 1.1240 short-term and only a break of this would suggest the current upward pressure has eased, then exposing 1.1180/00 support on the week.

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.