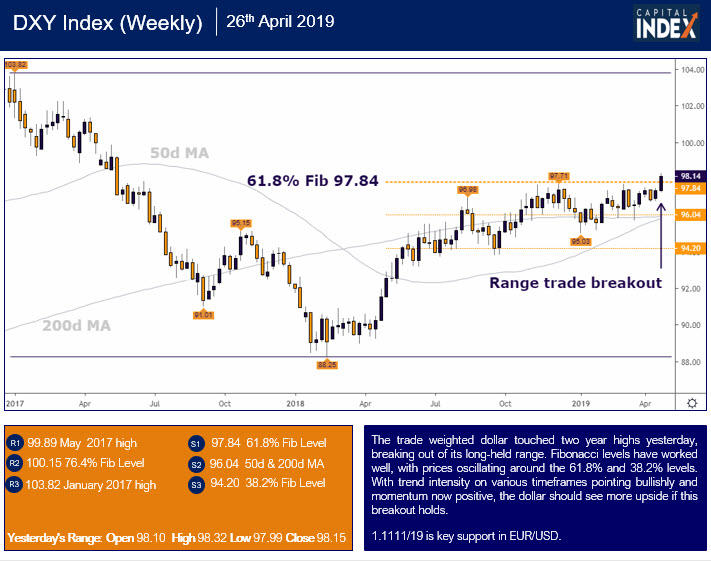

We had been talking about the low volatility in FX markets for some time and hey presto, we now seem to have been woken from our FX slumber. After weeks and in some cases months of range trading, the major currencies have all made significant new lows against the USD this week, driving the market-weighted DXY to new highs and the best level in nearly two years.

Let's look at three talking points around this breakout move by the dollar, remembering that these types of moves can be especially important. Volatility is non-random meaning after periods of contraction like we have witnessed, intraday ranges are starting to extend. With new cycle highs as well, the likelihood of a more dynamic, trending environment is high, which is great news for the majority of traders!

1. From a macro perspective, the dollar is deriving support as other central banks abandon tightening plans and bias. Sweden was the latest to do so yesterday, saying it will hold its main rate steady longer than previously expected and also announcing an 18-month bond-buying programme. Canada and Japan also shifted into a more dovish gear this week. This means the market only now prices some modest tightening for Norway and the UK over the next year.

In essence, after the Fed's abrupt, dovish volte-face, other central banks are following the FOMC's lead.

2. On the flip side, bond spreads between G10 countries have narrowed in recent weeks. And even if the US still enjoys a significant yield advantage over its major currency partners, the greenback would generally not benefit from this. Yet, the dollar march has continued with little new information to validate the extension.

3. Position-wise, according to last week's market report, the aggregate USD long has climbed for three consecutive weeks and is pushing back toward the $32.5bn multi-year high reached in December 2018. We also note that the EUR remains the largest held net short. This is important to remember when looking at the well-followed dollar index (DXY) which is heavily weighted towards the euro (roughly 58%).

All eyes will now be on today's US GDP where expectations are high after a series of positive surprises in US data. The Atlanta Fed GDP Now model forecasts a 2.7% print and it's hard to believe it was predicting growth of just 0.2% six weeks ago.

Consensus sees GDP of 2.3% so near-term at least, be wary of a 'buy the rumour, sell the fact' type of move taking place in the dollar. Focus will then switch to the upcoming 'super week' with a Federal Reserve meeting plus the monthly US jobs report.

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.