Today, the Fed starts its two-day meeting with the release of its statement tomorrow evening alongside revised economic projections of FOMC members, including a fresh ‘dot plot’, and then Chair Powell’s press conference.

The markets are clamouring for a rate cut, or at a minimum, a signal of a precautionary cut next month which would be the first in more than a decade. The key question for one of the most eagerly anticipated Fed meetings of recent times is a simple one - is the easing priced into Fed Funds futures over the next 12 months overdone?

Elevated geopolitical and trade issues, weakness in manufacturing indicators and downward trends in consumer prices and inflation expectations mean the conditions for a ‘patient’ stance are fading. But there is still tightness in the labour market and retail sales showed up well last week indicating that any demise of the US consumer is overstated.

It is certainly a conundrum for the Fed with relatively stable data continuing to fight off the protracted trade conflict. There is also a potential game-changing Trump/Xi G20 Meeting due to take place at the end of June.

Ulitmately, the Fed has to walk a tight-rope on their market message whilst also trying to achieve some stability. The strong bounce in stock markets, now only a couple of percentage points off their all-time highs, will disappear fast if there is no explicit willingness by the FOMC to more accommodation.

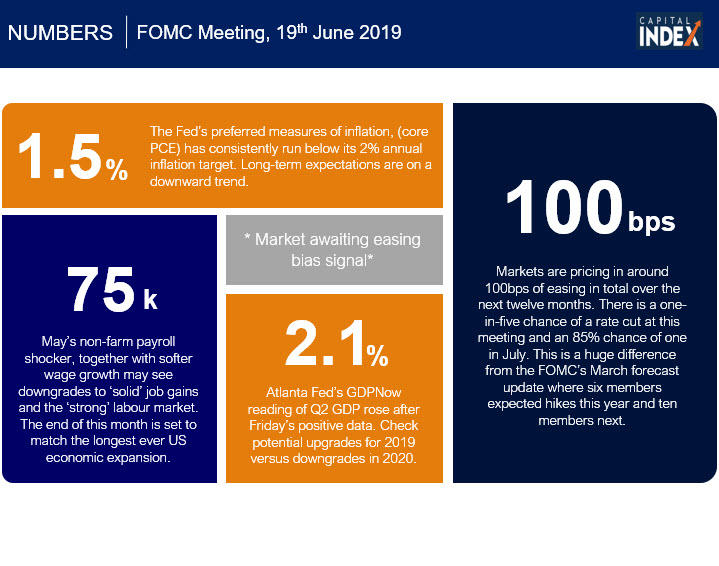

Here are some of the numbers to know ahead of the meeting:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.