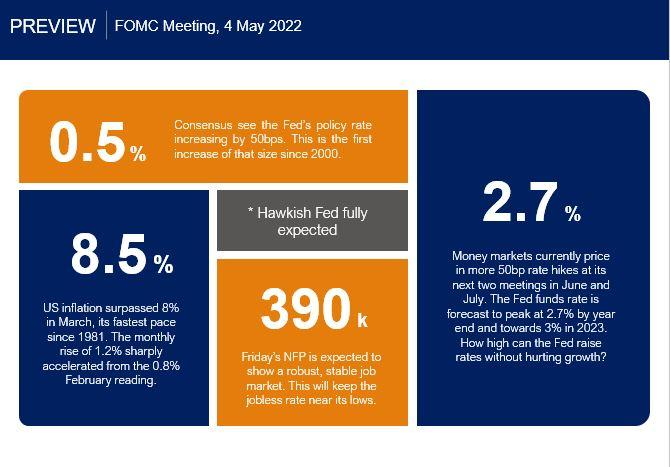

After much speculation, it is widely assumed that the US Federal Reserve will raise interest rates by 50bp, the first increase of that size since the turn of the century. The aggressive step is just the first of three half point moves anticipated by markets at its next meetings. Policymakers are focused on the historic pace of inflation at 40-year highs and the associated risks.

Fed officials have left investors in no doubt that they intend to front-load rate hikes to get the Fed Funds target rate quickly back to neutral. That rate is one that is consistent with full employment and capacity utilisation, as well as stable prices. The March FOMC minutes revealed that a 50bp hike could have been on the table had it not been for the Ukraine conflict. It is a rare event when the Fed even considers delivering something that was not pre-discounted by the market (even if often pushed there by the Fed in the first place).

Chair Powell has also said it was appropriate to “be moving a little more quickly” to tighten policy. Nothing in the March dot plot indicates that the Fed plans on pausing rate rises any time soon. Inflation is at 8%+ and a tight labour market should trump the surprise first quarter GDP contraction. Wages are rising amid a lack of workers with most economists seeing CPI above 4% across this year.

Markets are betting that rates, currently between 0.25% and 0.5%, will be lifted to 2.7% by the end of 2022. Financial conditions have begun to tighten, in anticipation of quantitative tightening that should be formally announced on Wednesday. We also note that sentiment figures have been edging lower recently. This could point to a cyclical slowdown in the second half of the year.

But monetary policy remains highly accommodative with the US 10-year “real” rate only just turning positive. That means it is still below neutral which means policy is easy. In fact, many economists see risks may be skewed towards faster rate moves and an even stronger dollar. A half point rate rise is baked in so it will be down to Chair Powell and a repeat of an “expeditious” normalisation of policy to keep the buck bid.

Here are the key numbers to know ahead of the meeting:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.