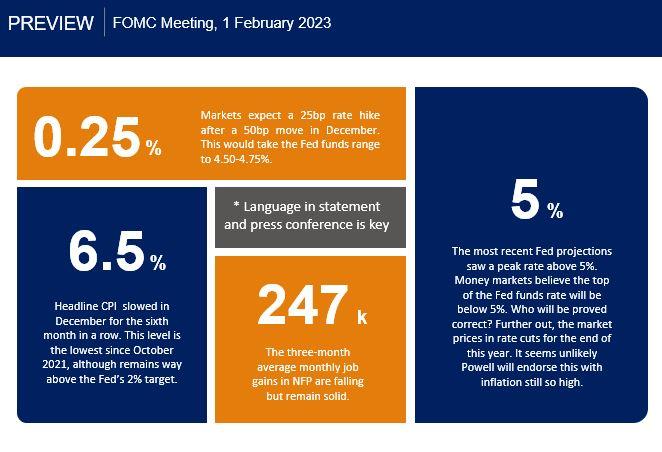

After the most aggressive policy tightening in over 40 years, the Fed is readying itself for a slower pace of rate hikes starting with a modest 25bp hike on Wednesday. That will take the target range to 4.50-4.75% which is still below the FOMC’s peak projected rate of 5.00-5.25% pencilled in by officials in December. So does slowing mean stopping?

Inflation remains well above target and a tight labour market likely means the FOMC has more work to do. Financial conditions have also fallen to levels they were at before the Fed embarked on its tightening cycle, which implies price pressures could stay higher for longer. But officials will be wary of hiking rates too far and hastening a deeper economic slowdown. They may also want to see the impact of their previous rate rises over time.

It seems a softer economic picture is spreading with recent data, including recent retail sales and industrial production data, indicating that a mild recession may not be far away. This has seen money markets price in rate cuts by the end of the year, which stands in stark contrast to most recent Fed rhetoric which continues to be focused on elevated price pressures and keeping rates higher for longer.

The dollar bear trend looks to be forming a base, but much will depend on any changes to the statement language on the outlook for rate hikes to see if this holds. Expectations are that “ongoing increases” remain “appropriate” so any softening in this language would be dovish and hurt USD. Chair Powell’s justification for a slower pace of rate hikes and any hints on the terminal rate during the press conference will also be a key focus.

“Don’t fight the Fed” would point to a concerted push-back by the Fed Chair and a bid in the greenback, with broadening signs of a recession looked through for now. Powell could reiterate the December dots of above 5% being still relevant and historical lessons about the dangers of easing rates too soon.

Here are the numbers to know ahead of the meeting: