The big news on Tuesday is that Italian bond yields are lurching higher once more and have tested the air above 3.4% earlier today. This is spooking the markets, with European stocks a sea of red and safe-haven currencies benefitting. The markets have seen a Eurozone debt crisis unfold before: first one country goes down and then contagion strikes. The question now is, will Italy’s Budget crisis spread to other European nations, or have Portugal, Spain, Ireland et al, done enough since the first debt crisis to bolster themselves from the turbulence emanating from Rome?

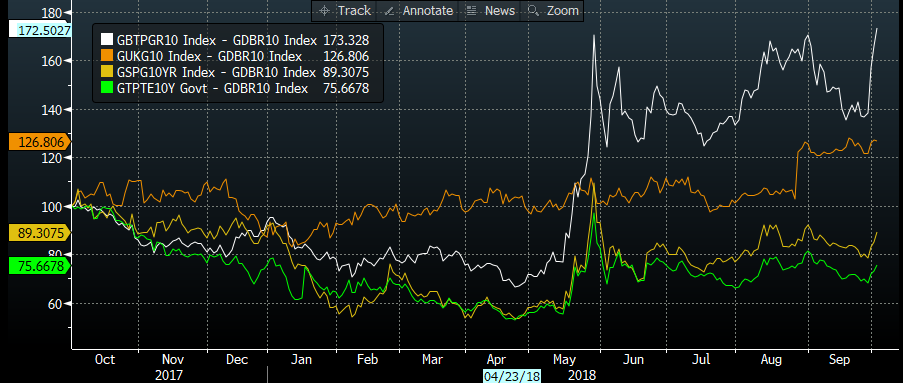

Chart 1 below looks at the spread between Italy and German 10-year debt, Spain and German 10-year debt, Portugal and German 10-year debt and I have also added the UK and German 10 -year debt. As you can see, Italy’s yield spread with Germany has surged well above the other countries’ spreads, which suggests this is an Italy-centric crisis for now. However, Spain and Portugal’s yield spreads are starting to rise. Right now, this rise looks like a small, knee jerk reaction and nothing to worry about, but we will watch this chart carefully in the coming days.

Chart 1:

Source: Bloomberg and Capital Index

Is Italy contained?

This is a tough question to answer. The moment Italy voted in this radical government the writing was on the wall that a crisis of some sort would erupt, not least because the large League Party has some vocal anti-EU elements within it. Thus, a rise in Italy’s yield spread, by itself, should be a crisis that the euro was expecting. This will become a wider problem if the market believes that other countries who have experienced extreme EU austerity, such as Spain and Portugal, follow Italy’s lead and push through budgets with large public sector deficits. This would highlight a disintegration of Germany’s fiscal leadership of the currency bloc and could spell bad news for the future of the Eurozone. Thus, to answer the question in the title of this note, we are not yet experiencing Eurozone debt crisis 2.0, however, how this chart evolves will give us a clear indication whether contagion risks are mounting.

We would point out that the Credit Default Swaps market, which is a symbol of the riskiness of Italian government debt, has also risen sharply in recent days. However, Italy’s CDS has been elevated since May, suggesting that the sophisticated, long term holders of Italian debt have been hedging their positions ever since May’s election. Thus, the current Budget crisis is notg a shock to all bond holders, which explains the muted reaction in the CDS market to Italy’s Budget.

Should we worry about the UK spread?

Chart 1 has been normalised to show how the Italian, Portuguese, Spanish and British yield spreads vs. Germany move together. As you can see, the UK’s spread with Germany is second highest after Germany. We believe that this is mostly due to the Bank of England’s recent rate hikes, rather than a sign of the growing riskiness of UK debt vs. German debt. Instead, politics is once again the biggest fear-factor for the pound and UK asset prices this week.

Can Theresa May knock the pound for 6, again?

It is a risky week for the pound. Theresa May gives her keynote speech to the Conservative Party Conference tomorrow at 10am, but the market is already pricing in a discount based on any negative tone regarding the Brexit negotiations and the prospect of the UK leaving the EU with a decent trade deal in 6 months’ time. and since the Brexit vote in 2016, this speech has typically led to a decline in the pound. Cast your mind back and remember when Theresa May first coined the term “hard Brexit”, and touted the prospect of leaving the EU without a trade deal, that was back in October 2016 and GBP/USD dropped by an impressive 7%. As we lead up to this year’s speech, the pound has once again dipped below $1.30 erasing more than 61.8% of gains made in September when GBP/USD reached a high of $1.3298. This suggests to us that a return to $1.2786 – the low from 5th September - could be on the cards. Combined with concerns about the currency bloc caused by Italy’s Budget, the UK’s Brexit negotiations have become extremely complex for the FX market to price in. Leaving without a trade deal is bad, but will the EU even exist in the future if Italy’s government are disobeying Eurozone rules and venting anti-Eu sentiment? In a nutshell, Theresa May is damned if she does and damned if she doesn’t regarding these Brexit negotiations, and her miserable position is reflected in the performance of sterling.

Elsewhere, the negative tone to European stocks is reflected in the US futures’ market, which is also pointing to decline at the US open. The Vix is likely to jump at the open, but we expect this to be temporary unless we see some major contagion in Europe in the coming days.