It's a Bank of England 'Super Thursday' tomorrow which means the monetary policy meeting is accompanied by its minutes and the quarterly inflation report (QIR). No major changes are expected so the Bank rate will remain unchanged at 0.75%.

The MPC will have an opportunity to reflect on the current policy outlook and many analysts are looking for Carney to reaffirm its interest rate guidance of slowly rising rates. Of interest will be if we see a change in the voting pattern of the Committee, with much recent speculation of a more hawkish shift.

However, the six-month Brexit delay has meant continued uncertainty for business investment, even if the cliff-edge has been avoided for now. Carney & Co are seemingly stuck in a holding pattern at present, given there is only one other 'super (QIR) meeting' until the new Brexit deadline.

Of course, if we do get clarity on the UK's exit in the second half of the year, then expect more concrete hawkish statements.

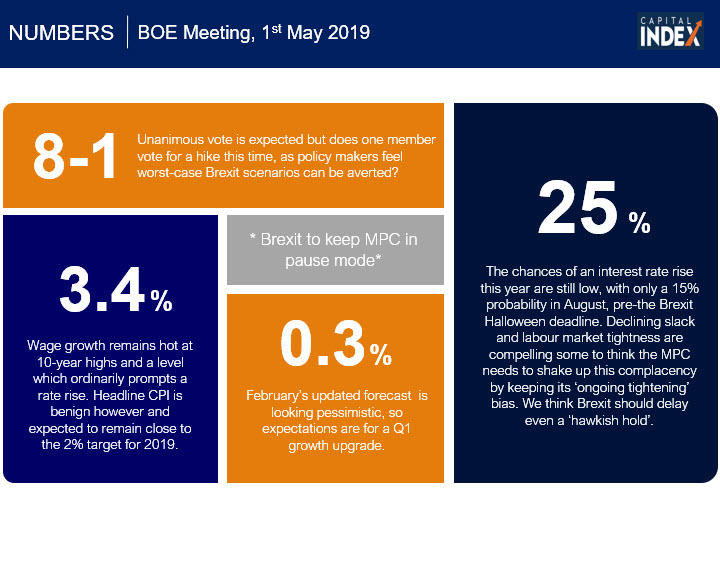

Here are the numbers to know ahead of the meeting:

Technically, cable has popped higher through key trend resistance at 1.3000 and is holding gains above the 100-day and 200-day moving averages. Gains suggest scope for the rebound to extend through to the 1.3075/1.3125 area in the near term, which gets us just below a long-term Fib level at 1.3144. Support is seen around 1.2965 where the 100-day and 200-day moving average signals converge.

We've also seen more upside for sterling versus the euro as the cross eased a bit further below 0.86 to test bids just ahead of a near-term 50% retracement (0.8583). The topside failure below previous resistance / support near 0.87 could set the stage for the next downside extension back towards the recent lows near 0.85, especially if we get a more hawkish shift from the MPC. Only a break above 0.8684 negates this downward momentum.

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.