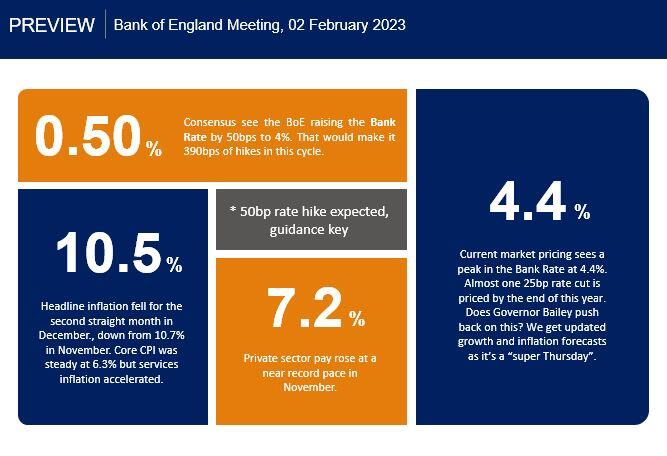

The Bank of England is likely to match the ECB on Thursday and hike rates by 50bps at its meeting and decision announcement scheduled for midday. It’s a “Super Thursday” which means we get to see the latest growth and inflation forecasts from the MPC. All eyes will be on the inflation projections with a steeper than expected cut suggesting a sooner-than-expected end to the bank’s tightening cycle. Much scrutiny will also be on the guidance over the peak, terminal rate.

UK headline inflation has been stuck in double-digits for five of the past six months with December’s 10.5% print still uncomfortably near to the October multi-decade high of 11.1%. Persistently high wage growth, which hit a near record high above 7% recently, and services inflation add to the uncomfortable position for policymakers.

But receding inflation expectations and the slowdown evident in areas like housing and mortgage approvals could see the MPC adopt a more cautious tone. Real GDP has already shrunk, and the composite PMI survey has been stuck below 50 denoting contraction for six months in a row. The impact of the stronger pound and moderating energy prices also supports a steadier bias by the MPC and could point to a vote split leaning increasingly towards just one more rate hike.

Weaker growth through the year plus longer-term challenges like the large twin deficits may hold sterling back over the next few months. Recent strength in cable has been a surprise to many, but it will need Governor Bailey to pull out a hawkish surprise to see the pair push to new cycle highs. Of course, a more dovish Fed tonight would propel the major north.

Here are the numbers to know ahead of the meeting: