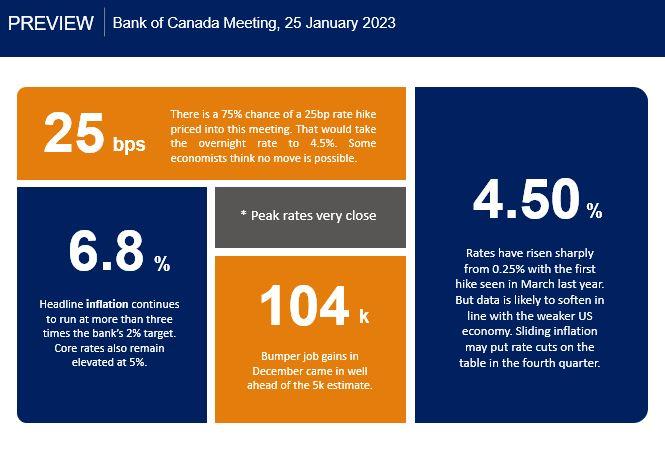

The Bank of Canada meeting is expected to see policymakers raise rates by 25bps for one final time in this tightening cycle. That will take the overnight rate to 4.5% with the bank pausing in order to assess the impact of multiple hikes which have included a jumbo 100bp rate move. Markets will be looking to see if this is the definitive peak in rates from a central bank that front-loaded hikes, with rate cuts potentially set for the end of this year.

At its meeting in December when it lifted rates by 50bps, the bank said it “will be considering whether the policy interest rate needs to rise further” as it “continues to assess how tighter monetary policy is working” and “how inflation and inflation expectations are responding”. This was taken as a sure sign that the BoC was very close to a downshift in its pace of rate hikes. More recently, Governor Macklem has noted that high inflation means the bank needs to be more concerned with under-tightening. This means the risk is not raising rates enough rather than doing too much.

Since December, core inflation has continued to remain high and sticky, the job market is still strong and elevated wages have all pointed to growth momentum into the end of last year. On the flip side there has been slowing in some activity with waning headline inflation. The housing market is also coming under pressure from the rise in mortgage rates. This might mean the aggressive rate hikes seen early in the cycle could allow policymakers to pause earlier than consensus thinks, especially if the bank reiterates that is it keen to consider the impact of the front-loading and whether more rate rises are needed.

Regarding the loonie, no hike at all will pressure the CAD as a 25bp rate hike is close to fully priced in by money markets. Similarly, if we see a “dovish” hike, so one accompanied by more cautious language and talk of peak rates, the CAD may also struggle to find any bids. The bank will likely use flexible language going forward in order to keep its options open. It is not expected to commit just yet and rely on economic data to determine the near-term term rate path.

Here are the key number to know ahead of the meeting: