The Bank of Canada meets tomorrow and is expected to leave its policy rate unchanged. However, with most major central banks pivoting towards a dovish bias or monetary policy easing in some form, markets are betting that the bank will move away from its current data dependent, neutral mode and jump on the dovish bandwagon.

Much has changed since the last BoC rendez-vous nearly two months ago. At that July meeting, they suggested that there was little prospect of any near-term policy change. Officials highlighted the improvements to the domestic story and we've seen further positive economic surprises amid on-target core inflation and escalating wage growth. What’s more, concerns about the housing market seem to have faded for the time being.

That said, growth risks posed by global trade tensions have now markedly increased, which in turn risks dampening commodity prices and curbing manufacturing activity. This is especially significant when you remember that commodities represent a large proportion of domestic output and with mineral extraction and agriculture representing more than 10% of the economy.

All this means that the BoC will again have to tread a fine line between emphasising downside risks to the outlook while flagging recent domestic strength. Any more neutral statement that buys the BoC more time to assess developments suggests to us some risk of market sentiment and positioning being surprised.

We note that this is a meeting-only affair with no press conference as opposed to the October 30 one which entails the MPR’s full forecast reassessment. By that date, further evidence of domestic strength and external headwinds will have been assessed.

Also worth remembering, as we highlighted in our preview before the July meeting, is that the BoC raised interest rates far less aggressively than the Federal Reserve so while rate cuts look likely in the US, monetary policy is still described as “accommodative” in Canada. This gives the bank slightly more of a policy buffer against any downside risks.

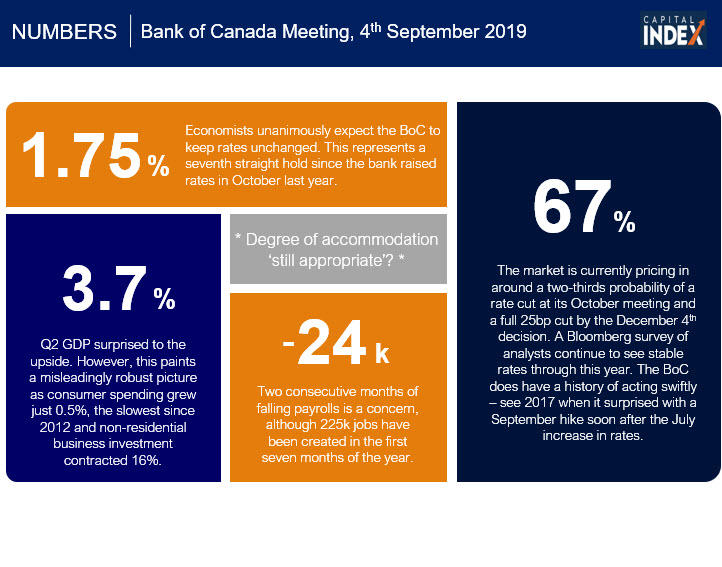

Here are the numbers to know ahead of the meeting:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.