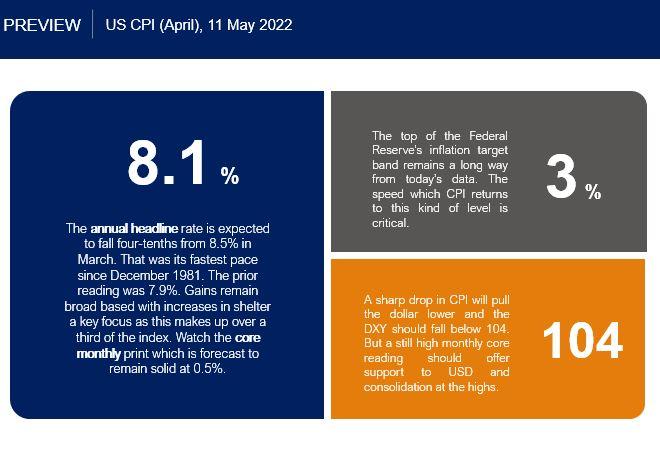

We get the key release of the week today with the latest US consumer price figures. This is now probably the single most important data for global markets. The headline annual CPI number is expected to fall to 8.1% from the 40-year high of 8.5% in March. This would be the first time the headline figure has fallen since August last year. Is this a major psychological moment for markets? Have we finally reached “peak inflation”?

Breakeven forecasts for the next five and ten years are dropping sharply, below the significant 3% level. Other measures, for example the New York Fed’s latest survey of consumer expectations, have also showed a down tick.

The longer-term question beyond this is really the speed at which prices might return to 3% which is the top of the Federal Reserve’s target band. Geopolitical tensions and China’s zero-Covid policy will continue to pressure supply chains. Tight labour markets could also see a wage growth spiral. But it will certainly be a major shock if the headline continues to rise. This would see further selling in stocks and a bid to the dollar.

There will be much focus on the core reading which is forecast to fall to 6.1% from 6.5%. This data excludes food and fuel which continue to be roiled by the Ukraine conflict. Monthly figures have actually dropped in each of the last two months, but economists polled by Bloomberg predict a month-on-month rise. Of course, this does not help the “peak inflation” narrative. On the flip side markets will take another fall very positively.

Here are the key numbers to know ahead of data release:

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.The trading of Foreign Exchange, and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Before deciding to trade forex, commodity or Index based CFDs you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that Capital Index (UK) Ltd is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.